Next: Local efficient frontier

Up: The general -factor Gaussian

Previous: Expected excess returns and

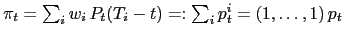

A portfolio of

-bonds (

-bonds ( ) shall have price

) shall have price

, i.e. the value of the

position in the

, i.e. the value of the

position in the  -bond at time

-bond at time  is

is  .

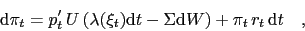

The price process satisfies

.

The price process satisfies

|

(27) |

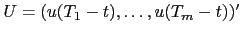

where

,

,

.

.

Subsections

Markus Mayer

2009-06-22