Next: Bond portfolios

Up: The general -factor Gaussian

Previous: The forward curve

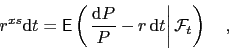

The instantaneous conditional expected excess return is

|

(24) |

with

Since

,

,

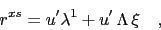

the conditional expected excess return is

the conditional expected excess return is

|

(25) |

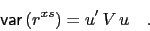

and the conditional instantaneous excess return variance is

|

(26) |

For a choice of  key rates

key rates

the conditional expected excess return is

the conditional expected excess return is

Markus Mayer

2009-06-22

![\begin{eqnarray*}

\frac{\mathrm{d}P}{P} &=& \frac{\mathrm{d}u^\prime}{\mathrm{d...

...\left[\lambda(\xi)\,\mathrm{d}t-\Sigma\mathrm{d}W\right]\quad .

\end{eqnarray*}](img96.png)

![\begin{eqnarray*}

\mathsf E\left[r^{xs}\vert{\mathsf y_{\mathrm{kr}}}\right]

...

...sf U\Lambda\mathsf U_{\mathrm{kr}}^- {\mathsf v}\right] \quad .

\end{eqnarray*}](img101.png)