Next: Expected excess returns and

Up: The general -factor Gaussian

Previous: Conditional finite-time yield dynamics

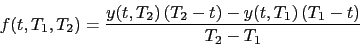

The forward rate  at time

at time  is defined as

is defined as

|

(20) |

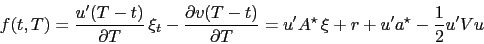

and the instantaneous forward rate  at time t is

at time t is

![\begin{displaymath}

f(t,T) = \lim_{T_1\to T_2} f(t,T_1,T_2) = \frac{\partial\left[(T-t)\,y(t,T)\right]}{\partial T} \quad .

\end{displaymath}](img88.png) |

(21) |

Inserting the expression for  yields

yields

|

(22) |

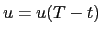

where it is understood that  ,

,  , etc.

, etc.

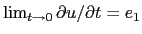

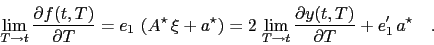

Short end slope The short end of the instantaneous forward curve is naturally related the short end of the

zero curve, but also contains information about risk premia: Since

the short-end forward slope is

the short-end forward slope is

|

(23) |

Markus Mayer

2009-06-22

![]() the short-end forward slope is

the short-end forward slope is