Next:

Up: Special results for EFM(2)

Previous:

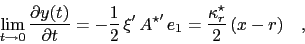

For the particular form of  under specification EFM(2) the short-end slope becomes

under specification EFM(2) the short-end slope becomes

|

(65) |

i.e. a risk-free rate  below the medium-term mean ('target')

below the medium-term mean ('target')  means a upward

sloping money-market curve. This makes economic sense since, in the medium term, in that case

the short rate is expected to rise. In EFM(2) the slope of the money-market curve is proportional to

the divergence between the short rate and the mid-term target.

means a upward

sloping money-market curve. This makes economic sense since, in the medium term, in that case

the short rate is expected to rise. In EFM(2) the slope of the money-market curve is proportional to

the divergence between the short rate and the mid-term target.

Markus Mayer

2009-06-22