Next: Sensitivity of yields to

Up: The general -factor Gaussian

Previous: Sensitivity of prices and

Partial yield curve inversion using linearity in some parameters

Yields  are affine in state variables

are affine in state variables  and constant risk premia

and constant risk premia

. (As usual

. (As usual  represents the yield curve as a vector of yields at selected

maturities.) Write again

represents the yield curve as a vector of yields at selected

maturities.) Write again

.

Linearity of

.

Linearity of  in

in  enters through

enters through  . Rewrite

. Rewrite  by

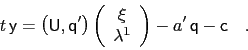

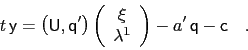

splitting it into the parts linear and constant in

by

splitting it into the parts linear and constant in  ,

,

|

(37) |

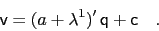

Then altogether

|

(38) |

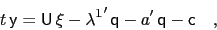

and the following linear problem has to be solved:

|

(39) |

Depending on the number of maturities observed the inversion can

either be done exactly or a linear fit can be sought. Some entries of

can also be prespecified and be moved into the constant

part.

can also be prespecified and be moved into the constant

part.

Markus Mayer

2009-06-22