Next: Partial yield curve inversion

Up: The general -factor Gaussian

Previous: Finite time portfolio evolution

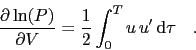

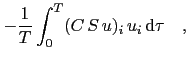

Bond prices depend on the covariance matrix  only through the affine term

only through the affine term  , and therefore

, and therefore

|

(33) |

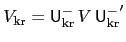

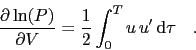

Given  key-rates the model-covariance matrix

key-rates the model-covariance matrix  can be mapped to the key-rate

covariance matrix via

can be mapped to the key-rate

covariance matrix via

. This gives

. This gives

|

(34) |

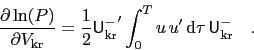

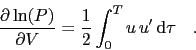

With factor volatilities

and diagonal volatility matrix

and diagonal volatility matrix

the correlation matrix reads

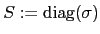

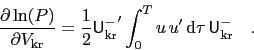

the correlation matrix reads  . This gives yield-sensitivities to volatility and correlation

. This gives yield-sensitivities to volatility and correlation

The sign of the yield-sensitivities depends crucially on the factor-correlations.

Markus Mayer

2009-06-22

![$\displaystyle -{1\over 2}\,S^-\left[{1\over T}\int_0^T u\,u^\prime\,\mathrm{d}\tau\right]\,S^-\quad .$](img128.png)