Next: Properties of the term

Up: The general -factor Gaussian

Previous: Notation

Bond prices

Consider the general Gaussian real-world n-factor model under objective measure

|

(1) |

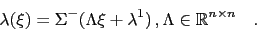

Via Girsanov transform to risk-neutral measure  with

with

and

and  affine:

affine:

|

(2) |

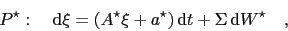

Introducing

and

and

leads to risk-neutral dynamics

leads to risk-neutral dynamics

|

(3) |

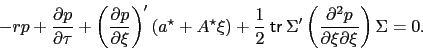

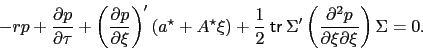

The price  of a T-Bond (i.e. a zero-bond of maturity

of a T-Bond (i.e. a zero-bond of maturity  ) at time

) at time  then satisfies the PDE

then satisfies the PDE

|

(4) |

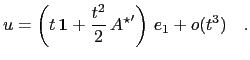

Setting  the ansatz

the ansatz

leads to the following two ODEs

leads to the following two ODEs

with initial conditions  and

and  .

The function

.

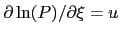

The function  has a natural interpretation as duration with respect to the rates

has a natural interpretation as duration with respect to the rates  , since

, since

.

The solutions to the two ODEs are 1

.

The solutions to the two ODEs are 1

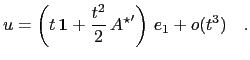

The asymptotics of  for

for  will be useful:

will be useful:

|

|

|

(9) |

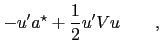

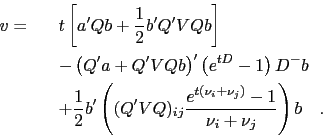

We turn to the calculation of  and

and  via diagonalization of

via diagonalization of

.

To avoid clutter the star

.

To avoid clutter the star will be dropped for the remainder of this subsection,

i.e. we write

will be dropped for the remainder of this subsection,

i.e. we write  for

for  , etc.

, etc.

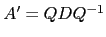

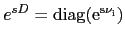

Assuming  can be diagonalised

can be diagonalised

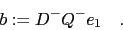

with diagonal

with diagonal  the solution

may be rewritten

the solution

may be rewritten

where the following abbrevation was introduced:

|

(10) |

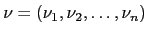

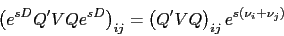

Denote the eigenvalues of  by

by

. Then

. Then

and

and

and

and

|

(11) |

which makes integration towards  straightforward:

straightforward:

This can be written in another form,

or, using the result for  from section

from section ![[*]](crossref.png) below,

below,

Next: Properties of the term

Up: The general -factor Gaussian

Previous: Notation

Markus Mayer

2009-06-22

![$\displaystyle \int_0^t ds\left[-{a^\star}^\prime u + {1\over 2} u^\prime V u\right]\quad .$](img36.png)

![]() and

and ![]() via diagonalization of

via diagonalization of

![]() .

To avoid clutter the star

.

To avoid clutter the star![]() will be dropped for the remainder of this subsection,

i.e. we write

will be dropped for the remainder of this subsection,

i.e. we write ![]() for

for ![]() , etc.

, etc.

![]() can be diagonalised

can be diagonalised

![]() with diagonal

with diagonal ![]() the solution

may be rewritten

the solution

may be rewritten

![\begin{eqnarray*}

u &=& Q\left(e^{t D} -1\right) b\\

v &=& \int_0^t ds\left[a...

...\over 2} b^\prime e^{s D} Q^\prime V Q e^{s D} b\right] \quad ,

\end{eqnarray*}](img47.png)

![\begin{eqnarray*}

v = && a^\prime Q\left(t-\left(e^{tD}-1\right)D^-\right)b \\ ...

..._j)}-1}{\nu_i+\nu_j}-\frac{e^{t\nu_j}-1}{\nu_j}\right]\right) b

\end{eqnarray*}](img54.png)

![[*]](crossref.png) below,

below,

![\begin{eqnarray*}

v = && -t\,y(\infty) + a^\prime Q\left(-\left(e^{tD}-1\right)...

...\nu_i+\nu_j}-\frac{e^{t\nu_j}-1}{\nu_j}\right]\right) b \quad .

\end{eqnarray*}](img56.png)